University finance is no longer a back-office function. It directly influences institutional stability, accreditation readiness, and long-term sustainability. However, many institutions still rely on semi-digital fee processes, delayed reconciliation, and reactive tracking models.

An AI-Powered Fee Management System for Universities redefines this structure. Instead of merely collecting payments, it builds predictive intelligence into financial governance. Moreover, when embedded within a unified Education Management System (EMS), it strengthens Digital solutions for higher education across departments.

Financial digitization is no longer about convenience. It is about institutional control.

The Hidden Risk Inside Traditional Fee Systems

Most universities offer online payments. Yet digital transactions alone do not create financial visibility.

Manual reconciliation, spreadsheet dependency, and fragmented dashboards create:

- Revenue leakage

- Delayed financial forecasting

- Limited audit readiness

- Compliance exposure

- Student dissatisfaction due to unclear fee tracking

As discussed in our analysis on legacy university systems, fragmented data architectures often prevent institutions from reaching operational maturity.

Therefore, the real challenge is not payment collection. It is intelligent orchestration.

The Evolution Toward an AI-Powered Fee Management System for Universities

An AI-Powered Fee Management System for Universities transforms static finance operations into predictive ecosystems.

AI-driven fee analytics identify:

- High-risk delayed payment patterns

- Installment default probability

- Scholarship impact forecasting

- Seasonal cash flow variations

Consequently, finance leaders gain foresight rather than reactive insight.

This predictive approach mirrors how AI now supports academics and lifecycle tracking, as explored in our work on student lifecycle management. When institutions connect financial data with behavioral analytics, risk detection becomes proactive.

Automation does not replace teams. It empowers them.

Cloud-Based Financial Governance and Real-Time Dashboards

AI intelligence must operate on scalable infrastructure. Therefore, cloud-native architecture becomes essential.

A cloud-based fee management system ensures:

- Real-time revenue dashboards

- Instant reconciliation across gateways

- Secure payment processing

- Centralized compliance visibility

- Anywhere access for authorized stakeholders

As emphasized in our insights on cloud security in higher education, institutions require more than hosting—they require encrypted governance frameworks.

Meanwhile, centralized dashboards allow leadership to align budgets with live revenue data. This shift transforms financial reporting into strategic intelligence.

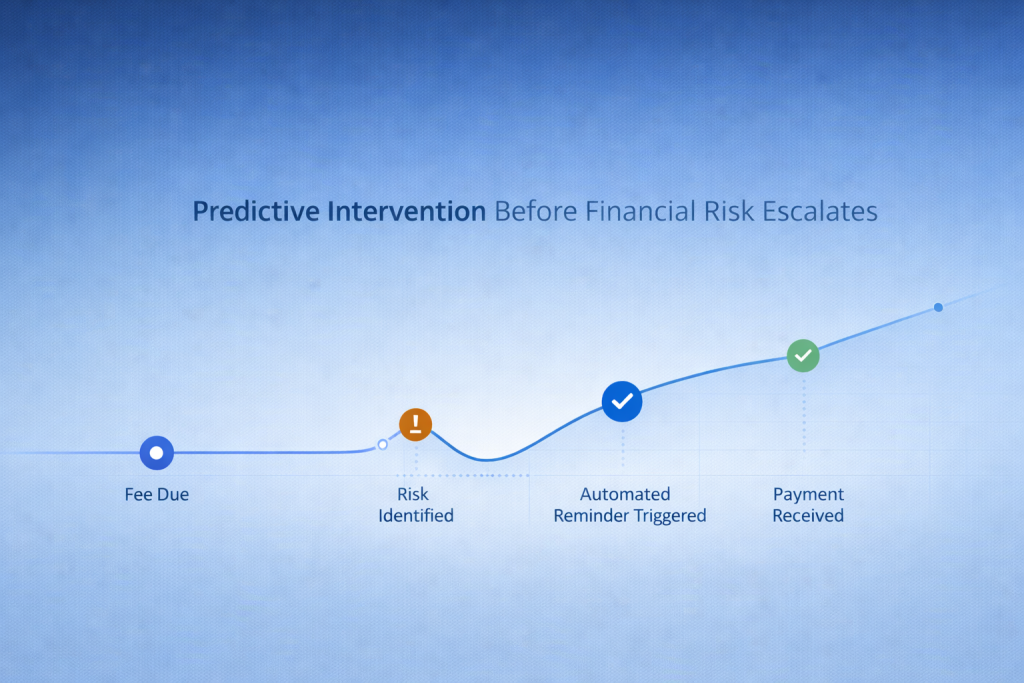

Predictive Alerts and Intelligent Automation

Traditional reminder systems follow fixed schedules. However, predictive fee defaulter alerts adapt to real-time behavior.

For instance:

- AI flags potential delays early

- Contextual reminders trigger automatically

- Installment plans adjust dynamically

- Finance heads receive priority exception alerts

Therefore, institutions improve collection rates without creating friction.

This predictive logic reflects the same AI-enabled readiness philosophy used in exam preparation analytics, where early detection improves outcomes.

Intelligence always outperforms reaction.

Eliminating Reconciliation Chaos Through Digital Precision

Manual reconciliation consumes administrative hours. More importantly, it introduces avoidable risk.

An intelligent fee reconciliation engine:

- Matches payments across gateways instantly

- Aligns scholarships and concessions automatically

- Flags discrepancies in real time

- Maintains transparent audit trails

Consequently, audit readiness improves without additional workload.

As institutions have learned from accreditation data challenges, governance failures rarely stem from absence of effort. They stem from fragmented systems.

Precision eliminates fragmentation.

Connecting Fee Intelligence With the Academic Ecosystem

Finance does not operate in isolation. It influences admissions, course registration, examination access, and accreditation documentation.

When integrated with:

- student recruitment lifecycle management

- Outcome-Based LMS

- online classes and examination systems

- accreditation management workflows

Fee data becomes part of a unified governance model.

Moreover, institutions transitioning from traditional college ERP systems to modern EMS architectures experience stronger operational coherence.

Digital solutions for higher education require interconnected intelligence—not isolated modules.

Leadership-Level Decision Intelligence

University boards and finance committees require forward-looking insights.

An AI-Powered Fee Management System for Universities provides:

- Cash flow projections

- Department-wise revenue mapping

- Predictive defaulter modeling

- Scholarship impact dashboards

- Compliance monitoring visibility

Therefore, leadership decisions become data-backed rather than assumption-driven.

When fee management integrates within iCloudEMS, financial governance aligns seamlessly with academics, examinations, and institutional reporting.

Digital transformation becomes measurable.

A Strategic Reflection for Institutional Leaders

If your university still reconciles fees manually or tracks defaulters reactively, what invisible risks remain buried in spreadsheets?

And more importantly — does your finance system generate intelligence, or only transactions?

The institutions that will lead the next decade of higher education will not merely digitize payments. They will operationalize predictive financial governance.

Frequently Asked Leadership Questions

What is an AI-Powered Fee Management System for Universities?

It is a predictive financial automation platform that analyzes payment behavior, triggers intelligent alerts, automates reconciliation, and provides real-time dashboards within a unified Education Management System (EMS).

How does cloud-based fee management improve institutional governance?

Cloud infrastructure centralizes financial data, enables secure access, strengthens compliance tracking, and delivers real-time reporting. Consequently, leadership gains continuous visibility into institutional cash flow.

Why are predictive fee defaulter alerts critical?

Predictive alerts identify potential payment delays before they disrupt revenue cycles. Therefore, finance teams intervene early and reduce collection risk while preserving student relationships.

How does fee intelligence support accreditation and compliance?

Automated audit trails and centralized reporting simplify documentation for regulatory bodies. When connected with accreditation workflows, financial transparency strengthens institutional credibility.

How does fee management integrate with broader Digital solutions for higher education?

When embedded inside a unified Education Management System (EMS), fee operations align with admissions, academics, examinations, and compliance. This integration creates a cohesive institutional ecosystem.

If you are evaluating your institution’s financial transformation roadmap, what strategic capability matters most—automation, predictive alerts, or real-time governance visibility?

Your answer will define the next stage of institutional maturity.